Lifestyle investing for pension saving

Lifestyle investing is a globally recognised and widely used approach in pension saving and the main investment strategy chosen for many retirement plans. In the US, 96% of pension plans use Lifestyle investing as their investment approach*.

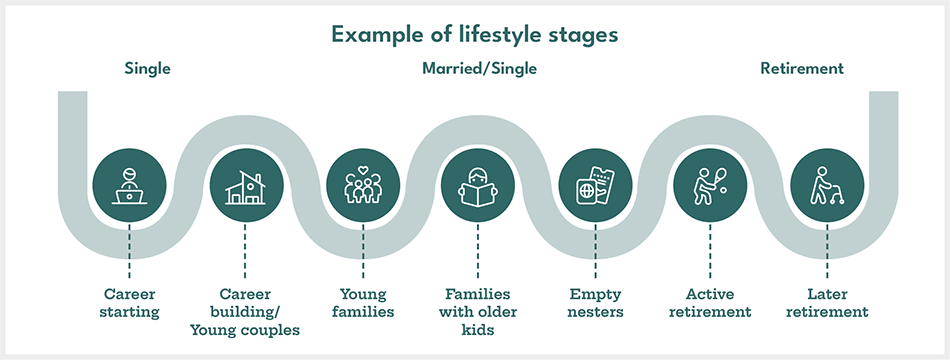

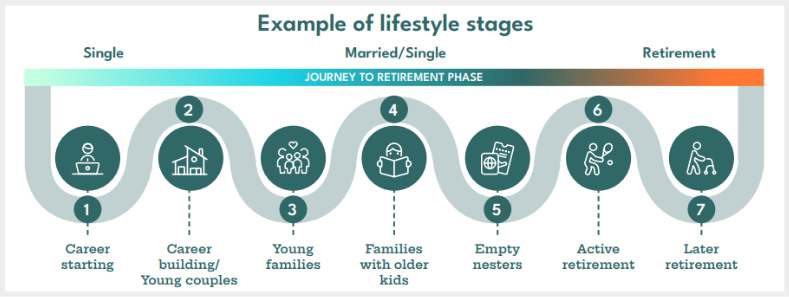

With a Lifestyle investing approach, you have your pension fund working for you over your entire career, automatically adapting for your changing pension needs as your Lifestyle needs change.

Lifestyle investment strategies bring you on a lifelong investment journey which recognises that:

- Your pension saving needs will be different depending on how far you are from your chosen year of retirement

- Over time, the mix of assets that your pensions savings have exposure to needs to adapt and evolve

+ Source: Vanguard, “How America Saves” (2024).

Individual Retirement Investment Solutions (IRIS)

At New Ireland, our flag ship lifestyle pension offering is Individual Retirement Investment Strategies (IRIS) - with active (IRIS) and passive options available.

IRIS makes saving for retirement easy by offering you:

- A 'one-stop' simplified pension solution

You invest in one single fund, we look after the rest over your journey to retirement. - A solution that is continuously evolved to meet your lifestyle needs and an ever-changing investment environment

- A solution that manages your retirement savings the way you want them to be managed

Designed for the long-term and to manage the impact of investment markets' highs and lows on your pension savings.

IRIS - key ingredients

1. Choosing a 'Target Date' for your retirement - before you invest you pick 'your target date or chosen year' of retirement that you are saving towards (which can change over time).

2. Adopting a 'Lifestyle' approach to investing - we understand that as you move through life your needs and wants change, our IRIS strategies have been designed to ensure you are invested in the right assets to suit each stage of your retirement saving journey, so all you need to do is 'invest' and we take care of the rest.

Our IRIS strategies have been designed recognising that these different 'Lifestyle' stages require a different approach to investing. It does this by adjusting the assets you have exposure to over time:

3. Multi-asset investment strategies - Our IRIS strategies adopt a multi-asset or diversified approach to deliver you the best potential returns. They provide you with exposure to the potential returns of a wide range of asset classes such as equities, property, bonds and cash. The amount invested in each of these asset classes will change depending on how near or far you are from target date (as outlined above).

At New Ireland, we have a proud heritage of over 30 years in bringing innovative and leading pension and investment solutions to the Irish market. Our IRIS and Passive IRIS solutions are a key part of that.

Our IRIS strategies - your choice

As choice underpins New Ireland's pension offering, within our IRIS solution we have two options - IRIS and Passive IRIS.

| IRIS | Passive IRIS | |

| You choose a target date | ||

| Adopts a lifestyle investing approach | ||

| Multi-asset investment strategy | ||

| Investment style | Actively managed - investment managers, appointed by New Ireland, decide what assets and how much to invest in these (with investment strategy). | Passively managed - no one fund manager selects specific assets to invest in, instead funds track the performance of specific markets/asset classes through an underlying index or portfolios. While Passive IRIS is, in general, a passively managed fund, any exposure to property and cash will be actively managed. |

For more information about our IRIS strategies and how these can help you reach your retirement goals:

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these funds you could lose some or all of the money you invest.

Warning: These funds may be affected by changes in currency exchange rates.