Benefits of the New Ireland Master Trust

The New Ireland Master Trust offers leading edge strengths that distinguish it from both the My Future Fund auto-enrolment scheme and other company pension plans.

Tailored plan design

Flexible contributions and Normal Retirement Age to suit your workforce.

Rapid plan setup

Digitisation means your plan can go live in days, not months.

Fast and easy onboarding

Employees join the plan in real time by email

Real-time integration

Smooth payroll & HR connectivity for accurate administration.

Member engagement

Award-winning communications and 24/7 self-service capability to empower employees

Investment choice

Wide fund range including our award winning Passive IRIS default strategy.

Market leading efficiencies in plan administration

Save time with automated processes, real time data and transactional capability, and self service tools.

Dedicated support

Our blend of cutting-edge digital innovation and personalised support from our Digital Support Team ensures exceptional service.

A greater appreciation of pension benefits

Helps employees better understand and appreciate their pension as a key part of their total reward.

Governance

Independent oversight by Dawson Master Trustee DAC.

If your company pension plan is currently on MyPension365 contact your Financial Broker or Advisor or email Neville Maxwell, Master Trust Distribution Manager here for more information.

If you'd like to know more about setting up a new plan on MyPension365 please talk to your Financial Broker or Advisor or email Neville Maxwell, Master Trust Distribution Manager here.

Evaluating the My Future Fund auto-enrolment scheme versus a master trust

While it is mandatory to enrol in scope employees into a suitable pension plan, employers can choose whether to enrol eligible employees into the My Future Fund scheme or into an alternative arrangement. An occupational (company) pension plan (or a Personal Retirement Savings Account (PRSA)) can be used instead if it meets certain minimum standards.

It's important that employers and employees are fully aware of the other options available to them and how these compare against the My Future Fund scheme to ensure that they are in the right pension arrangement for them. In many cases a Master Trust company pension plan is an ideal solution for both employers and employees. This is especially true for employees who pay tax at the higher rate.

A company pension plan gives employers control and flexibility that is not available under auto-enrolment.

This is a great time to review your existing pension plan (or consider setting one up), to ensure that your plan meets your needs both now and into the future, provides the efficiencies you need, and stands out as a best in class offering to your employees.

Comparison of key features of auto-enrolment versus a master trust

Auto-enrolment*

Master Trust**

- Rigid and fixed by the legislation.

- Starting at matching 1.5% of total income for both employer and employee rising to 6% matching after 10 years.

- Contributions are capped at €80,000 gross annual salary.

- No option for employer or employee to make additional contributions.

- Lump sum contributions not allowed.

- Complete flexibility (subject to Revenue limits) which allows employees pay more through Additional Voluntary Contributions (AVCs) if they want to fund for a higher retirement income.

- Option for employers and employees to make lump sum contributions.

- No tax relief on employee contributions.

- State top up contributions of €1 for every €3 the employee contributes.

- Marginal tax relief for employees through net pay (20% standard rate and 40% higher rate).

- Tax relief limits increase as employee gets older on both regular and lump sum contributions.

- In line with State Pension age 66.

- No voluntary early access allowed.

- Early access due to ill-health is allowed “in the event of incapacity or exceptional ill-health”.

- Employer can choose the Normal Retirement Age (NRA) which must be between 60 and 70.

- Employees who leave employment can take benefits from age 50.

- Employees can defer drawing down benefits to a time of their choosing.

- Provisions included for ill health including a full pay out of the fund in the case of very serious ill health.

- No risk benefits.

- Death in Service can be included.

- Income Protection can be included.

- 3 investment strategies - low risk, medium risk and high risk.

- Employees will be invested in the default option to begin and will have choice to move to one of the other strategies in the future.

- Wide investment choice

- None

- Professional and qualified advice available throughout the life of the plan.

- Expected to be a weekly flat fee to cover administration costs and an investment charge of up to 0.5%.

- Negotiated between advisor/provider and employer.

- Covers a range of services.

Source: *http://gov.ie/autoenrolment. **New Ireland

See our Future proofing your company pension plan flyer for more.

Visit our New Ireland Master Trust page to find out more

Auto-enrolment - a practical perspective

Watch our short webinar for employers who already have a company pension scheme in place. Claire Parsons, Senior Relationship Manager and Dave Churchard, Pensions Consultant give an overview of how auto-enrolment will work and the key factors that employers should consider when deciding the best approach to take. They also bring these considerations to life through employer case studies.

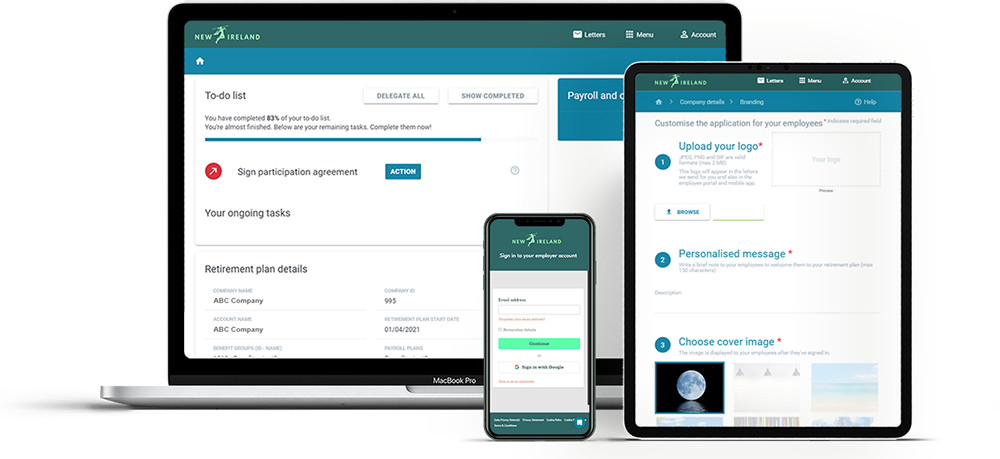

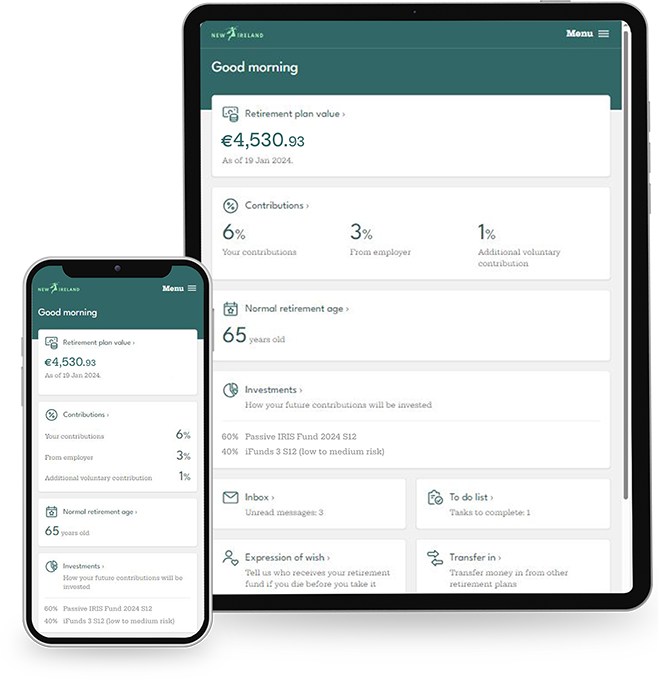

MyPension365 - delivering next generation digital solutions

MyPension365 combines automation, ongoing communication, and support to deliver a better experience for employers and employees alike.

Our blend of cutting edge digital innovation and personalised human support delivers an exceptional service to employers, members, Financial Brokers and Advisors and trustees. This has been recognised by our Pension Scheme Administrator of the Year Award win at the 2025 Irish Pensions Awards.

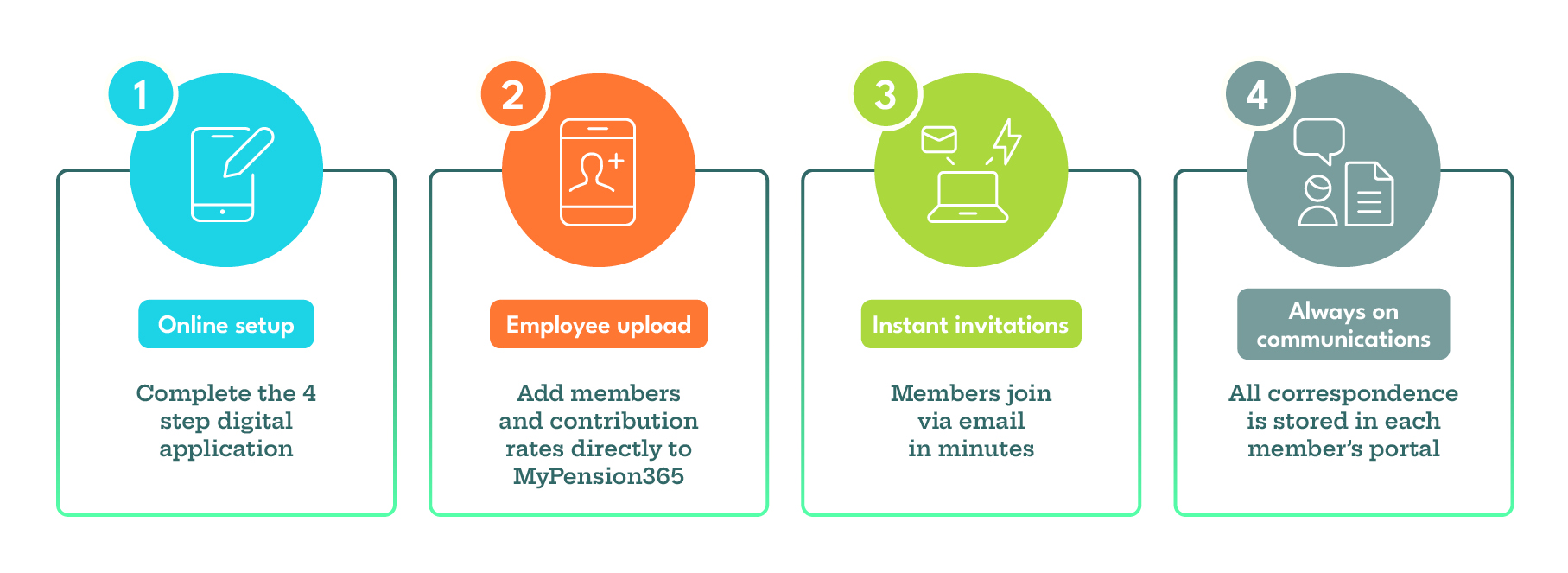

How it works

Employers benefit from fully digitised

end to end administration:

Members can easily

do the following:

Visit our MyPension365 page to find out more.

There’s lots to think about and it’s important to get the relevant information and the right advice to make the best choice for you.

In this short video, Neville Maxwell, our Master Trust Distribution Manager discusses how the New Ireland Master Trust could be an ideal solution benefitting both you and your employees.

Every employer’s circumstances are different so it’s important to get tailored advice from a Financial Broker or Advisor to ensure you choose the option most suited to your circumstances.

Contact us

Contact your Financial Broker or Advisor or Neville Maxwell, Master Trust Distribution Manager neville.maxwell@newireland.ie for more.

They can help you navigate the complexities of pension planning and tailor a solution that aligns with your company’s goals and the needs of your workforce.

For more detailed information on the My Future Fund auto-enrolment scheme, please visit the Government auto-enrolment page here.