The Eurozone economy has officially emerged from a record-long recession, led by Germany and France, according to second quarter data released by Bloomberg earlier this month.

These reports were released amid what was the first ‘sustained period of financial-market calm’ since the start of the debt crisis. Although the news was firm that we are not witnessing a recovery yet, a stabilisation is a notable step forward. This slightly more positive data is welcome, but we need to be mindful that this step forward must continue and there still needs to be another three or four quarters of positive growth in the Euro area to be viewed as ‘out of the woods’.

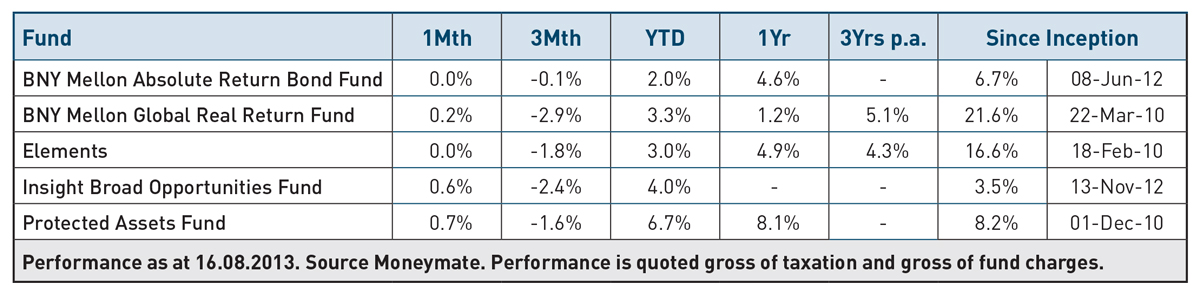

So, how have our pension risk managed funds performed so far this year?

Our popular risk managed funds continue to do their job with all 5 of the funds displaying positive performance for 2013.

To see how our full range of funds performed for July please view our latest Investment Plus.

Where relevant life assurance tax applies. The information provided should not be relied upon without seeking appropriate advice. We believe the sources of information to be reliable but we cannot guarantee the accuracy or completeness of the information. Mention of specific stocks/investments or funds does not constitute an offer or recommendation to buy or sell those stocks/investments or to subscribe to any of those funds or investment services. For details of a fund please refer to the fund brochure/flyer. Terms and conditions as set out in the relevant policy conditions apply.

Warning: Past performance is not a reliable guide to future performance.

Warning: These funds may be affected by changes in currency exchange rates.

Warning: If you invest in these funds you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.