PruFunds

PruFunds

New Ireland's PruFunds provide the potential for your clients' to grow their money while experiencing fewer extreme highs and lows that can come from investing directly in investment markets. This is achieved through an innovative smoothing process.

- PruFunds offer the potential for growth by investing in a diverse range of asset classes.

- The funds aim to smooth some of the more extreme short-term highs and lows which experienced with investment performance.

- The funds have access to a wide range of active investment opportunities including some which individual investors may not be able to access. The funds also have exposure to some passively managed investments.

- The funds are actively managed by skilled investment experts.

PruFunds - a choice of funds designed to suit different attitudes to risk and reward. Available across a range of pension and investment products. PruFunds (PruFund Cautious & PruFund Growth) are classified as Article 8 Funds in accordance with the Sustainable Finance Disclosure Regulation.

PruFund Cautious - a low to medium risk fund

This fund aims for steady and consistent growth over the medium to long-term through a cautious approach to investing. The fund aims to smooth the peaks and troughs of investment performance. The smoothing process helps achieve more stable returns than investing directly in stock market.

This fund is not suitable for you if:

- You need any level of capital protection.

- You tolerate high risk investing and seek to maximise growth on your investment.

To find out more about PruFund Cautious:

For fund performance, click here for our factsheet:

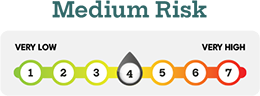

PruFund Growth - a medium risk fund

This fund aims to maximise growth over the medium to long-term. The fund aims to smooth the peaks and falls of investment performance. The smoothing process helps achieve more stable returns than investing directly in stock markets.

This fund is not suitable for you if:

- You need any level of capital protection.

- You tolerate high risk investing and seek to maximise growth on your investment.

To find out more about PruFund Growth:

For fund performance, click here for our factsheet:

Who May PruFunds be Suitable for?

- Clients looking for a better medium to long-term return than current interest rates can provide.

- Clients looking for greater certainty around expected future returns of their investment.

- Clients who may be considering de-risking an existing investment.

- Pension clients who may be considering their pre and post retirement options.