What is PRIME Funds

New Ireland's PRIME Funds range (PRIME) offers investors a unique solution to help them achieve their medium to long-term investment financial goals. PRIME also incorporates Environmental, Social and Governance (ESG) characteristics into its investment process.

- PRIME 3, 4 and 5 have been designed for investors who seek the type of returns that exposure to a range of asset classes can deliver. As the market value of assets can rise and fall over time, the funds aim to deliver a more stable investment journey for investors by managing risk through diversification and use of a dynamic risk adjustment mechanism.

- PRIME Equities provides exposure to developed market, emerging market and small-cap global equities. The fund seeks to deliver higher returns than the other PRIME funds but there is also a higher risk for investors as exposure is to a single asset class and the value of equities can vary significantly.

- PRIME Funds use a number of Environmental, Social and Governance (ESG) investment techniques to achieve its ESG characteristics. These include exclusions, tilting and asset stewardship. All 4 PRIME Funds (3, 4, 5 & Equities) are classified as Article 8 Funds in accordance with the Sustainable Finance Disclosure Regulation.

Working with experts

Investment Manager – State Street Investment Management

State Street Investment Management (State Street), has a proud heritage of passive investing. With over four decades experience, they have provided high quality passive funds that can help lower costs and allow investors to keep more of what their portfolios earn over time.

As one of the world's largest managers of passive assets, State Street offer a huge selection of funds — covering a multitude of asset classes, markets and regions. State Street also manage the New Ireland Property Fund that PRIME 3, 4 and 5 has exposure to.

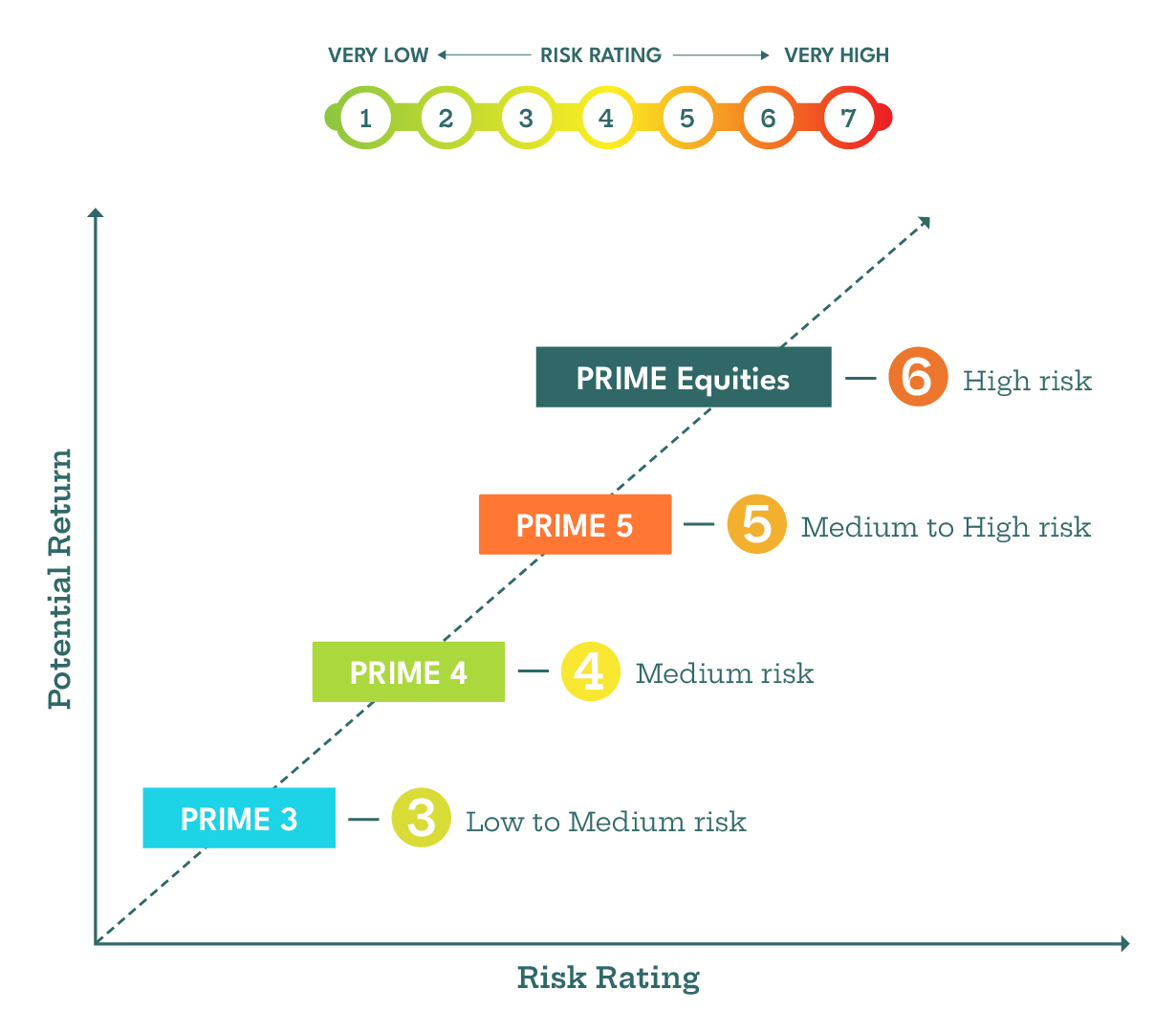

PRIME Funds & Risk Categories

At New Ireland, we classify our range of funds into seven different risk categories; from very low risk (1) to very high risk (7). This is to help you to better understand the risks to your investment.

PRIME 3 has exposure to developed market and emerging market equities, property, alternatives, euro short corporate, global investment grade and emerging market bonds and cash.

The exposure to equity markets and cash can change as a result of the dynamic risk adjustment mechanism. During times of high market volatility, the exposure to equities can be significantly different from the strategic allocation.

Exposure to property, alternatives and bonds is set. This is reviewed annually.

PRIME 4 has exposure to developed market, emerging market and global small-cap equities, property, euro short government, global investment grade and emerging market bonds, alternatives and cash.

The exposure to equity markets and cash can change as a result of the dynamic risk adjustment mechanism. During times of high market volatility, the exposure to equities can be significantly different from the strategic allocation.

Exposure to property, alternatives and bonds is set. This is reviewed annually.

PRIME 5 has exposure to developed market, emerging market and global small-cap equities, emerging market bonds, property and cash.

The exposure to equity markets and cash can change as a result of the dynamic risk adjustment mechanism. During times of high market volatility, the exposure to equities can be significantly different from the strategic allocation.

Exposure to small-cap global equities, bonds and property is set. This is reviewed annually.

PRIME Equities has exposure to developed market, emerging market and global small-cap equities. Exposure to equities is set. This is reviewed annually.

Why PRIME Funds?

Why PRIME Funds?

- Choice of 4 funds across the risk spectrum

- Passive

- Diversified

- Risk managed

- Article 8 Funds

- Investment expertise

- Standard charges apply

Why recommend PRIME Funds? Click here